Upcoming Changes to UK R&D Tax Credits from April 2023

New R&D rate changes greatly reduce the relief available for smaller companies but increase the relief available for large companies.

Research & Development (R&D) tax relief provide valuable financial support for the businesses in the UK that is investing in innovation and developing new processes, products or services. In this article our R&D experts will explain how the R&D tax relief regimes work after changes come into force in April 2023 may be of critical importance to your financial projections.

These changes only impact from this date, so a split year treatment will apply for company financial years straddling 1 April, for example companies with a December year end.

Why is the R&D tax relief regime changing?

The government has a target to raise investment in R&D to 2.4% of UK GDP by 2027. R&D tax relief contributes to that goal by reducing the cost of innovation for UK companies and the Government wants to make it more effective to increase “additionality” – the extra R&D spend that companies claiming the relief make. It is also introducing changes to the claims process in order to tackle errors and suspected abuse of the R&D tax relief regime.

New R&D tax relief rates for SMEs in the UK from 1 April 2023

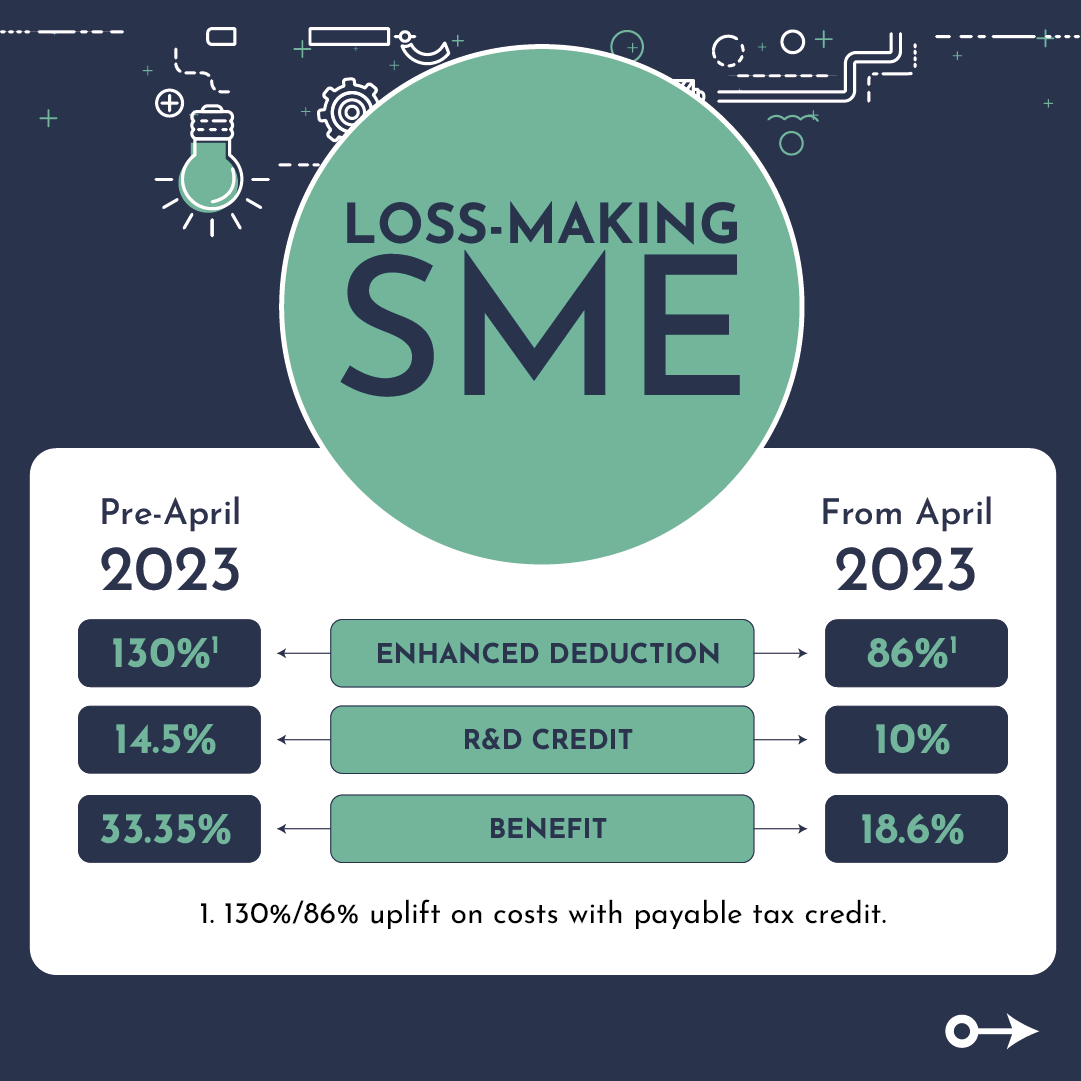

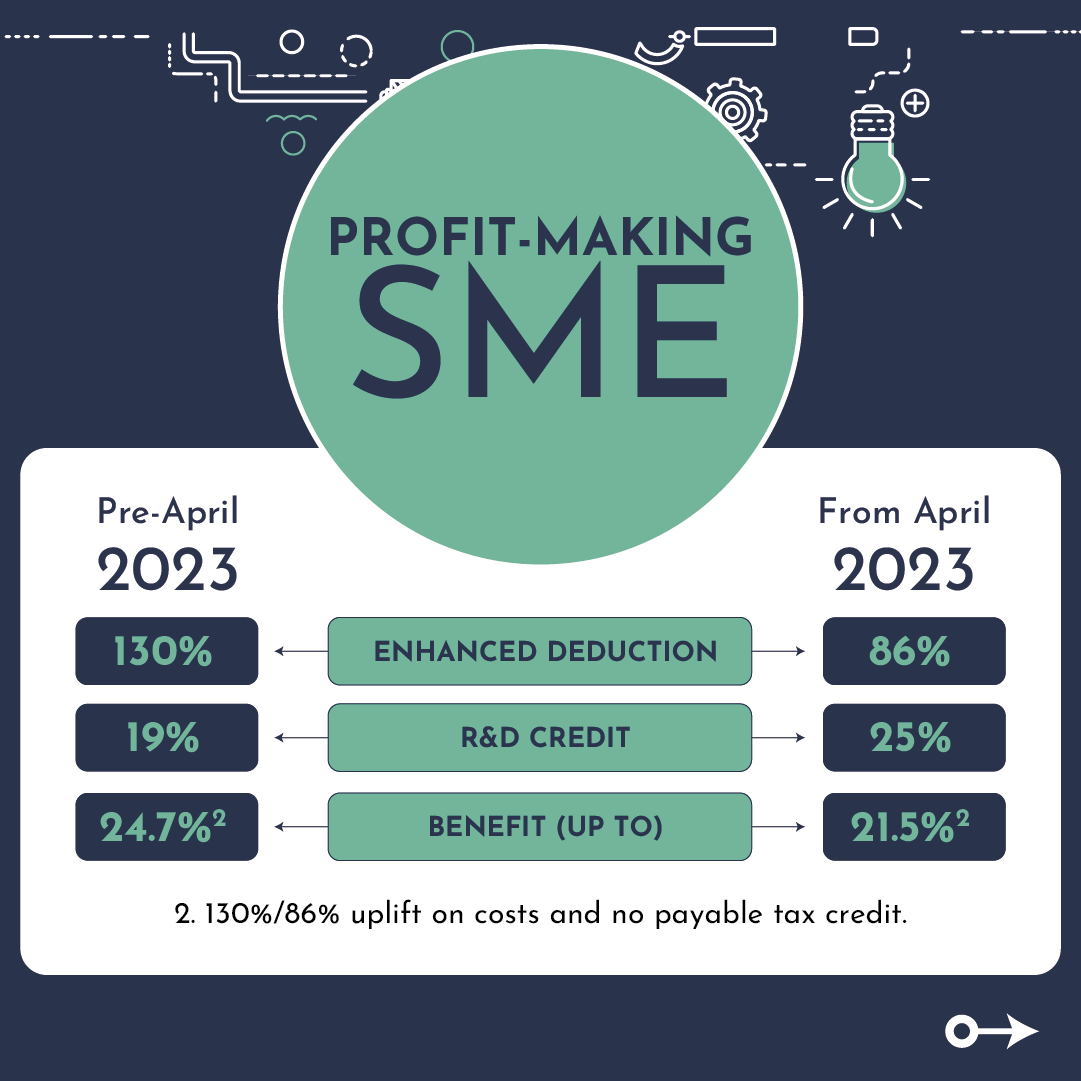

Overall, SME R&D tax relief is becoming less generous, as follows:

Previously where there was an enhancement rate of 130% on expenditure, and a 14.5% surrender rate to turn losses into a cash rebate, these rates are dropping to 86% and 10% respectively. Practically speaking, this means a loss-making company who previously would have recovered 33.35% of eligible expenditure as a cash rebate would now receive just 18.6%. For companies who are breaking even or profit making, the effective rate of relief will be somewhere between 8.6% and 21.5%, depending on your profit levels.

International subcontractor costs are now ineligible for R&D. This is except for when conditions necessary for the R&D don’t exist in the UK, those conditions exist where you decide to carry out the R&D, and it would be wholly unreasonable to create those conditions in the UK. An example would be developing a device designed to work in polar ice caps. Carrying out R&D abroad to create cost savings are explicitly not an allowable factor in these conditions.

R&D technical narratives are now a requirement rather than a recommendation.

If you have not claimed R&D in the last three accounting periods, you must now submit a claim notification. This submission needs to be made between the first day of the financial period and six months after the end of the financial period.

New R&D tax relief rates for Large UK Companies from 1 April 2023

The RDEC R&D tax credit scheme benefit arrives in the form of a reduced corporate tax bill or, in some circumstances, a payable cash credit.

For those claiming under the RDEC (Research & Development Expenditure Credit) scheme (generally where the R&D has been grant funded), issues 2, 3, and 4 from above hold true. The only difference is with the changes in rates, where the RDEC scheme is becoming more generous.

Previously where the RDEC effective relief rate (before tax) was 13% of eligible, this is now increased to 20%.

A company can claim RDEC going back two full financial years.

Making successful R&D tax relief claims

Further changes to R&D Incentives appear likely, where the government have noted it is their aim to reform the current R&D regimes into one simplified RDEC style incentive for all. HMRC is also increasing its scrutiny of R&D claims and penalties may be charged if errors are identified, making it crucial that claims are both correct and well-documented. The process of making an R&D tax claim can be complicated but there are some simple things you can do to improve the accuracy and the effectiveness of your R&D claims.

If you want to find out more about R&D Tax Relief and how this can benefit your business contact a member of our R&D team today.

Book a call with R&D Tax Credit Specialists ↓

Categories

- (S)EIS Tax Relief

- Accountancy Best Practice

- Art and Luxury Assets

- Business Immigration

- Commercial Law

- Commercial Litigation

- Corporate Law

- Corporate Strategy

- EMI Share Option Scheme

- ESG Compliance

- Employment Law

- Fundraising Strategy

- Human Resources

- Inheritance tax

- Intellectual Property

- Merger and Acquisition

- NFTs and Digital Trading

- R&D Tax Credits

- Startups & SME Advice

- Tax Advice

- UK Subsidiary

webinars FOR FOUNDERS

Don't forget to share this post!