Startups and SMEs face many challenges - make sure you know how to overcome them by exploring our blogs for the latest news and insights across a range of accountancy and legal topics.

- (S)EIS Tax Relief

- Accountancy Best Practice

- Art and Luxury Assets

- Business Immigration

- Commercial Law

- Commercial Litigation

- Corporate Law

- Corporate Strategy

- EMI Share Option Scheme

- ESG Compliance

- Employment Law

- Fundraising Strategy

- Human Resources

- Inheritance tax

- Intellectual Property

- Merger and Acquisition

- NFTs and Digital Trading

- R&D Tax Credits

- Startups & SME Advice

- Tax Advice

- UK Subsidiary

UK Budget 2024: Key Changes Effective from April 2024

The UK government's Spring Budget 2024, delivered in March 2024, outlined several key changes taking effect from April 2024. These changes aim to support individuals and businesses amidst ongoing economic challenges. Here's a summary of the main points in this article.

New Merged R&D Scheme Guide and Requirements

The objective of the merged R&D scheme is to simplify the UK's research and development (R&D) regimes by having a single set of qualifying rules. In today’s article our R&D experts have provided detailed guidance, regulations and rules of merged R&D scheme.

Upcoming Changes to UK R&D Tax Credits from April 2023

New R&D rate changes in 1 April 2023 greatly reduce the relief available for smaller companies but increase the relief available for large companies.

What the Autumn Statement Means for Startups & SMEs

Autumn Statement 2022: As the UK heads into recession the Chancellor, Jeremy Hunt, had a real balancing act to perform in the Autumn statement. Dragon Argent focus in on the key implications for founders and SMEs. Learn more.

Research and Development Tax Relief Changes 2023

From 1 April 2023, there are several changes to the UK R&D scheme to be implemented as a result of the 2021 Budget. We felt it useful to summarise these in this week’s newsletter with some help from our Head of Tax, Misha Patel.

Is my business eligible for R&D tax credits

Dragon Argent R&D tax specialists provide an end-to-end service that makes claiming R&D tax credits easy for you. The average UK SME R&D claim is worth £32,409* so don't miss out on the chance for a valuable cash injection for your business. How to claim R&D Tax Credits?

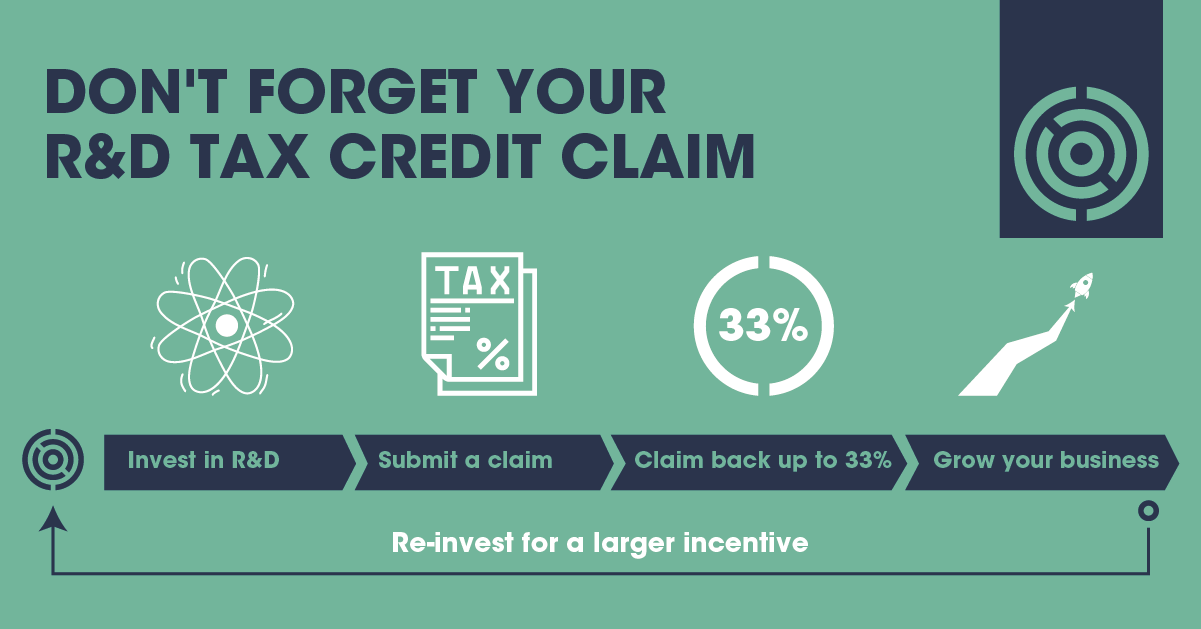

Don't Forget Your R&D Tax Credit Claim

Is your business missing out on a potential vital cash injection? Or could you reduce your corporation tax liability freeing up cash to invest in growth? In this week’s newsletter, we'll also provide a recap on the research and development tax credit essentials every business owner should know.

R&D Tax Credit Calculator For Startups & SMEs

HMRC estimates that approximately 75% of businesses that could qualify for an R&D tax credit don’t make a claim. If you think your business would qualify and you have eligible costs which you could claim again, use our R&D Tax calculator here to get an estimate of the value of a rebate.

What is Research & Development Tax Relief?

Many new businesses spend the first season of their existence researching and developing a concept or a prototype. If any project on which the company works is seeking to making an advance in the fields of science or technology, the costs of that project may be eligible to provide the company with extra tax relief, through its annual corporation tax return.

New R&D Tax Credit Cap – April 2021

As part of the forthcoming Finance Bill 2021, HMRC have announced a cap on the amount that a loss-making SME can receive in R&D tax credits to stop abuse of the scheme.